The Financial Group

We simplify all those essential financial decisions

THE EDUCATION SECTION

November 2016

A guide to Investment Risk & Return

What

is

Risk?

Over

the

past

few

years,

‘risk’

has

become

a

popular

term

in

the

context

of

investments.

This

is

in

part

due

to

the

fact

that

the

2008

financial

crisis

showed

how

many

investors

were

unsure

or

unclear

about

what

risks

they

had

been

taking

with

their

investments.

Before

2008

there

have

been

many

times

when

uncertainty

has

arisen

–

eg:

9/11

of

2001

&

Black

Monday

of

1987.

The

word

risk,

even

within

the

narrow

scope

of

investing,

can

be

viewed

in

many

different

ways.

One

distinction

we

can

make

is

between

investOR

risk

and

investMENT risk

.

What

is

investor

risk?

Investor

risk

can

be

described

as

the

possibility

of

not

being

able

to

match

your

future

outgoings with the savings pot you’ve accumulated for this purpose - eg: your pension fund.

This

risk

is

managed

by

financial

advisers

when

they

gather

information

regarding

the

future

cash

flow

requirements of a client, and advise accordingly.

What

is

investment

risk?

‘Investment

risk’

is

different

-

it

describes

the

fluctuations

in

value

of

a

portfolio

over

time.

For

many

of

our

clients,

the

main

concern

is

loss

of

capital.

While

this

is

applicable

in

the

case

of

highly

concentrated

investments

(such

as

a

few

stocks

or

shares)

it

is

less

applicable

in

the

case

of

a

diversified

portfolio.

Here,

the

risk

of

total

loss

is

spread

across

each

of

a

large

number

of

investments.

This

means

that

instead

of

looking

solely

at

potential

loss,

we

focus

on

the

predictability

of

expected

returns.

We

measure this predictability using volatility.

How do we work out the route forward?

The

starting

point

is

our

Risk

Questionnaire.

We

have

put

together

a

range

of

questions,

together

with

our

partners

FE

Analytics,

to

produce

a

report

that

we

use

as

a

discussion

document

that

we

can

talk

through

with

you

to

help

understand

your

thoughts

on

your

investments

&

the

‘risks’

that

you

are

happy

to

take

to

achieve

your

goals.

None

of

the

answers

are

‘set

in

stone’.

They

&

the

report

just

help

you

&

us

enormously

when we are discussing the best route forward.

Click

the

Risk

Questionnaire

image

if

you

would

like

to

complete

our

Risk

Questionnaire

&

receive

a

report

summarising your answers & our interpretaion of your Risk level.

What

is

volatility?

Mathematically,

volatility

is

the

standard

deviation

of

annual

returns.

(Wow!

Need

an

explanation?

Find

out

here

.)

Under

normal

market

conditions,

this

describes

the

range

of

returns

around

the

average you would expect to see in 2 years out of 3.

Clearly,

these

past

few

years

have

shown

that

markets

don’t

always

behave

‘normally’,

and

we

can

see

returns

which are much higher or lower than expected.

What

does

this

mean

for

you

as

an

investor?

There

is

a

need

to

find

a

balance

between

the

level

of

predictability

you

wish

to

have

in

your

investment

return,

and

the

level

of

return

you

are

aiming

for.

There

is

of

course

a

trade-off

to

be

made

here

-

asset

classes

with

highly

predictable

returns,

such

as

cash

or

gilts,

offer

little

by

way

of

a

‘premium’,

while

asset

classes

which

experience

greater

fluctuations,

such

as

equities,

can

offer higher returns, but with less ability to predict whether or not you’ll achieve these higher levels.

Managing

your

Investment

Risk.

Once

we

have

determined

the

level

of

predictability

you

wish

to

have,

the

aim

of

investing

is

then

to

manage

this

as

efficiently

as

possible.

In

other

words,

to

maximise

your

potential

return while maintaining the same level of predictability about that return.

There are 2 tools that are effective in achieving this -

diversification

and

compounding

.

•

Diversification.

Bond

prices,

which

benefit

from

falling

interest

rates

and

fear

in

equity

markets,

often

rise

while

equities

are

falling,

and

this

low

correlation

can

reduce

the

overall

portfolio

volatility

without

materially

impacting

the

expected

return.

This

effect

can

become

amplified

when

you

begin

to

introduce

alternative asset classes such as property or commodities.

A

balanced

portfolio,

comprising

of

equities,

bonds

and

alternatives,

should

therefore

produce

superior

returns per unit volatility compared with the individual asset classes.

•

Compounding

-

refers

to

holding

an

investment

for

a

longer

period

of

time,

meaning

there’s

a

greater

likelihood

of

achieving

the

expected

annual

return.

By

increasing

the

amount

of

time

that

the

investment

is

held

for,

the

impact

of annual variation in portfolio returns can be minimised.

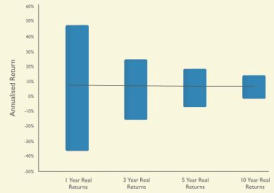

The

chart

on

the

right

shows

the

maximum

and

minimum

annualised

real

returns

of

UK

equities

since

1985,

showing

how

the

return

on

an

investment

becomes

more

predictable as the time horizon increases.

The

average

annual

return

realised

over

this

timeframe

doesn’t

really

differ

and

sits

at

around

7%

per

annum,

but

holding

the

investment

for

10

years

rather

than

1,

3,

or

5

years

significantly

increases

the

likelihood

of

realising

the

expected annual return.

As always,

please do not hesitate to

contact us

if you would like further details or information.

- In the News

- The Housing Market

- The Education Section

- Income Drawdown

- ISAs

- Lisa & Help to Buy ISA

- Risk v Return

- Stamp Duty Land Tax

- Archive

- Oct 2011 State Pensions

- Nov 2011 Structured Products

- Dec 2011 Pound Cost Averaging

- Jan 2012 Trusts

- Feb 2012 ASU

- Mar 2012

- Apr 2012 House Surveys

- May 2012 Options at retirement

- Jun 2012 IHT

- July 2012 FSCS

- Aug 21012 Index

- Sep 2012 EU Gender Directive & I minus E

- Oct 2012 Interest Only mortgages

- Nov 2012 NEST

- Feb 2013 APR

- Apr 2013

- May 2013 Investing in Funds pt1

- June 2013 Investing in Funds pt2

- July 2014 New ISAs

![Close [x]](index_htm_files/close.png)